Which of the following terms relates to disability income insurance – Disability income insurance, a crucial component of financial planning, provides a safety net against the unforeseen circumstances that can impact earning capacity. Understanding its significance and the factors influencing its eligibility is essential for individuals seeking financial security.

This comprehensive guide delves into the intricacies of disability income insurance, exploring its types, coverage options, and the process of qualifying for and filing claims. By providing a clear understanding of this insurance, we aim to empower individuals to make informed decisions that safeguard their financial well-being.

Disability Income Insurance Definition

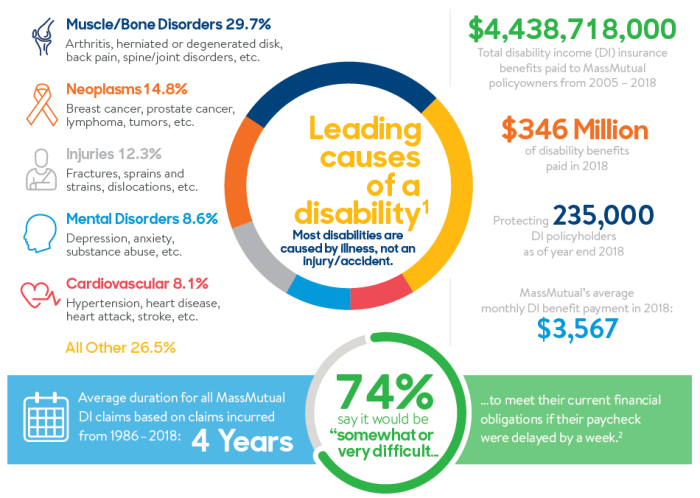

Disability income insurance is a type of insurance that provides financial protection in the event that an individual is unable to work due to a disability.

Examples of events covered by disability income insurance include:

- Illness or injury that prevents an individual from performing their job duties

- Long-term disability that prevents an individual from working for an extended period of time

- Permanent disability that prevents an individual from working for the rest of their life

The benefits of having disability income insurance include:

- Provides financial security in the event of a disability

- Helps to cover living expenses, medical bills, and other financial obligations

- Protects an individual’s income and financial future

Types of Disability Income Insurance

Individual Disability Income Insurance

Individual disability income insurance is a type of insurance that provides coverage for an individual who is unable to work due to a disability.

Coverage options and limitations of individual disability income insurance include:

- Own-occupation coverage:Provides benefits if an individual is unable to perform their own occupation due to a disability.

- Any-occupation coverage:Provides benefits if an individual is unable to perform any occupation due to a disability.

- Benefit period:The length of time that benefits will be paid, which can range from two years to the age of 65.

- Benefit amount:The amount of money that will be paid each month in benefits, which is typically a percentage of an individual’s income.

Group Disability Income Insurance, Which of the following terms relates to disability income insurance

Group disability income insurance is a type of insurance that is offered by employers to their employees.

Coverage options and limitations of group disability income insurance include:

- Short-term disability insurance:Provides benefits for a short period of time, typically up to six months.

- Long-term disability insurance:Provides benefits for a longer period of time, typically up to two years or the age of 65.

- Benefit amount:The amount of money that will be paid each month in benefits, which is typically a percentage of an individual’s income.

Factors to Consider When Choosing a Type of Disability Income Insurance

- Occupation and income

- Health and medical history

- Financial situation

- Coverage options and limitations of different types of disability income insurance

Eligibility and Qualification for Disability Income Insurance

Eligibility Criteria for Disability Income Insurance

The eligibility criteria for disability income insurance vary depending on the type of insurance and the insurance company.

General eligibility criteria include:

- Be employed or self-employed

- Have a valid Social Security number

- Be a U.S. citizen or permanent resident

- Be under the age of 65

Process of Qualifying for Disability Income Insurance

The process of qualifying for disability income insurance involves:

- Applying for coverage

- Providing medical and financial information

- Undergoing a medical examination

- Being approved for coverage

Medical and Financial Requirements

Medical and financial requirements for disability income insurance vary depending on the type of insurance and the insurance company.

General medical requirements include:

- Good health

- No history of serious illness or injury

General financial requirements include:

- Sufficient income to support the cost of premiums

- Good credit history

Claim Process for Disability Income Insurance

Steps Involved in Filing a Claim

The steps involved in filing a claim for disability income insurance include:

- Contacting the insurance company

- Providing medical documentation of the disability

- Completing a claim form

- Submitting the claim to the insurance company

Documentation and Information Required to Support a Claim

Documentation and information required to support a claim for disability income insurance include:

- Medical records

- Employment records

- Financial records

Timeline and Factors that Can Affect Claim Processing

The timeline for claim processing varies depending on the insurance company and the complexity of the claim.

Factors that can affect claim processing include:

- The severity of the disability

- The availability of medical records

- The insurance company’s claims process

Comparison with Other Insurance Policies: Which Of The Following Terms Relates To Disability Income Insurance

Disability Income Insurance vs. Life Insurance

Disability income insurance provides financial protection in the event that an individual is unable to work due to a disability, while life insurance provides financial protection in the event of death.

Similarities between disability income insurance and life insurance include:

- Both provide financial protection

- Both involve paying premiums

Differences between disability income insurance and life insurance include:

- Disability income insurance provides benefits while an individual is living, while life insurance provides benefits after an individual dies.

- Disability income insurance benefits are typically based on an individual’s income, while life insurance benefits are typically a fixed amount.

Disability Income Insurance vs. Health Insurance

Disability income insurance provides financial protection in the event that an individual is unable to work due to a disability, while health insurance provides financial protection for medical expenses.

Similarities between disability income insurance and health insurance include:

- Both provide financial protection

- Both involve paying premiums

Differences between disability income insurance and health insurance include:

- Disability income insurance provides benefits for lost income, while health insurance provides benefits for medical expenses.

- Disability income insurance benefits are typically based on an individual’s income, while health insurance benefits are typically based on the cost of medical care.

FAQ Insights

What events are typically covered by disability income insurance?

Disability income insurance generally covers events that result in an individual’s inability to perform their regular occupation due to illness, injury, or other qualifying conditions.

How long does it typically take to qualify for disability income insurance?

The qualification process for disability income insurance can vary depending on the insurance provider and the individual’s circumstances. However, it typically involves a medical examination and a review of financial and employment history.

What are some factors to consider when choosing a disability income insurance policy?

When selecting a disability income insurance policy, it’s important to consider factors such as the coverage amount, benefit period, waiting period, and premium costs. It’s also crucial to ensure the policy aligns with individual needs and financial situation.